A buy-to-let mortgage is often a great option for people looking to make a long term investment or enter the rental property market. Whether it’s your first property or you’ve been building up a portfolio of rental properties, the right buy-to-let mortgage can unlock your investment potential. Buy-to-let mortgages do work differently to residential mortgages, so get in contact to find out more about how we can help.

The amount you can borrow with a buy-to-let mortgage depends on how much you’re expecting to earn in rental income.

Mortgages and protection can be confusing, see the most commonly asked questions and answers, to put your mind at rest.

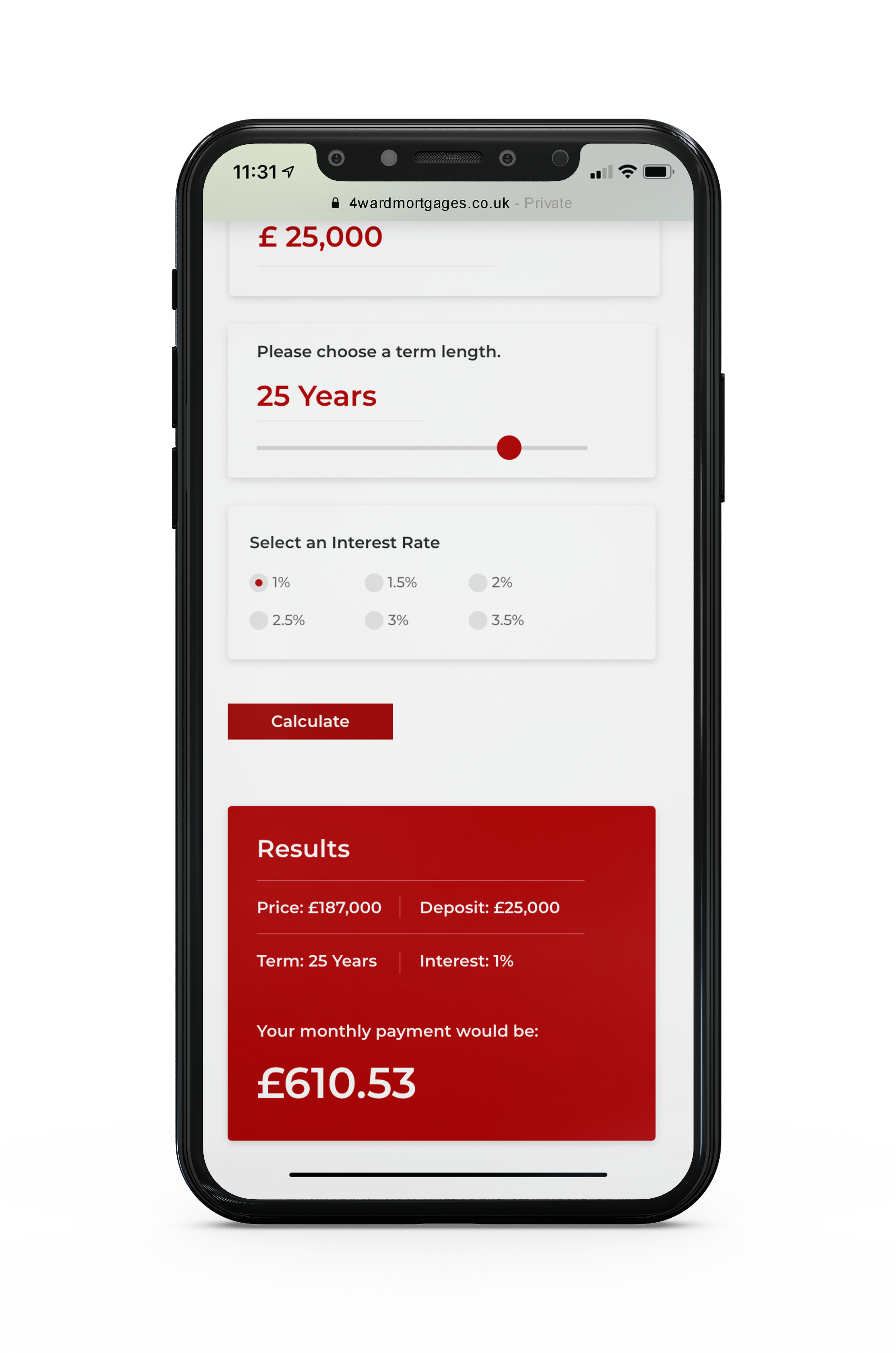

To get an exact figure on what you could borrow, it’s best that you book an appointment to speak with an adviser, who, once understanding you circumstances can provide you with a bespoke mortgage calculation.

It goes without saying that raising children can be expensive, so your income, or that of another household member, is often the only way to pay for the everyday costs that come with looking after a child.

If you or someone you rely on were to pass away, it would take its toll financially, in addition to the emotional stress. Life insurance is one way to have a safety net in place.

If you have life insurance, it’s a good idea to regularly review the cover to make sure it’s right for you and your current circumstances.

When you sign up for a policy, the extent of cover – how long it lasts, and how much it would pay out – is based on your financial situation and commitments at that time.

But these can change. Your life insurance policy needs to change as well to ensure your family is fully protected if the worst happens to you or your partner, so when moving home it’s important your cover still meets your needs.

Mortgage life insurance can be used to help your loved ones pay off your mortgage if you die.

This type of life insurance is often sold as a decreasing-term policy so, as you gradually pay off your mortgage, your pay-out reduces over time. A mortgage life insurance claim typically pays out as a lump sum.

It’s designed to protect your loved ones if you die before your mortgage has been paid off. It will provide them with a lump sum so they can clear the mortgage debt and have one less financial burden at an already difficult time.